Payments in the Italian automotive industry range between 60-90 to 120-150 days, depending on the end-buyer and whether working capital requirements can be obtained from banks or suppliers.

Italy

- Car registrations up again

- Worst may be over, but performance still weak

- Insolvencies still high

Italy’s GDP shrank again last year, by 1.8%, after contracting 2.4% in 2012, and private consumption decreased 2.6% in 2013. Against this backdrop, it is no surprise that Italy’s car industry remained depressed. According to the European Automobile Manufacturers´ Association (ACEA), new passenger car registrations in Italy fell 7% in 2013, compared to a 1.7% decrease in the EU.

However, it seems that the slump has begun to at least level off: in the period from January to August 2014 new passenger car registrations increased 3.5%. While in the first half of this year production of passenger cars fell 5.6%, output of light commercial vehicles recovered by 10.4%. However, the outlook for the second half of 2014 and into 2015 remains muted, as production and orders generally follow the trend of consumption – and private consumption is expected to do no more than level off in 2014 and grow by only 0.4% next year.

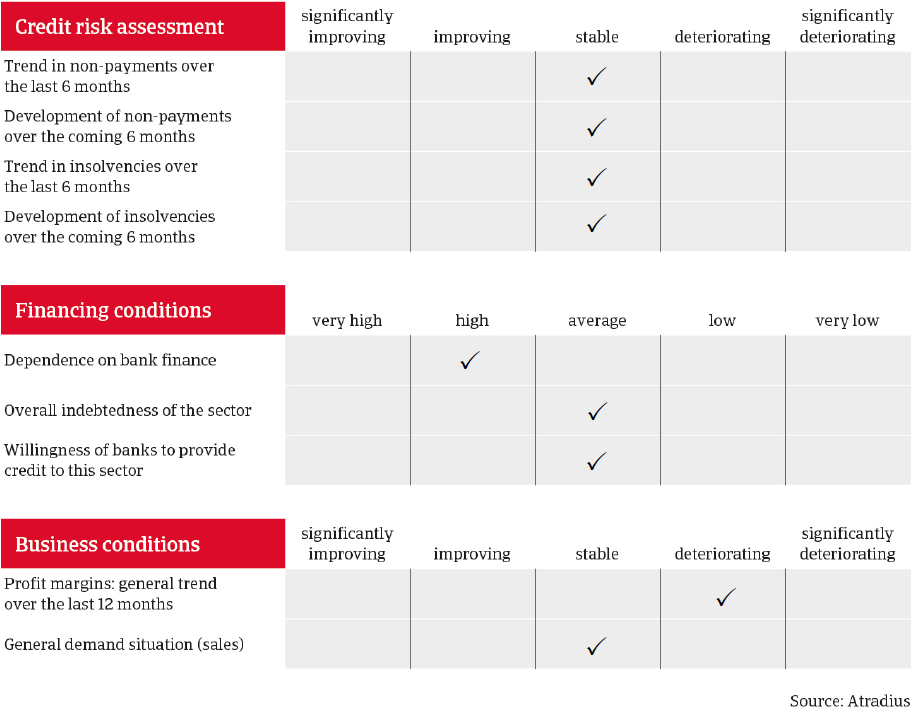

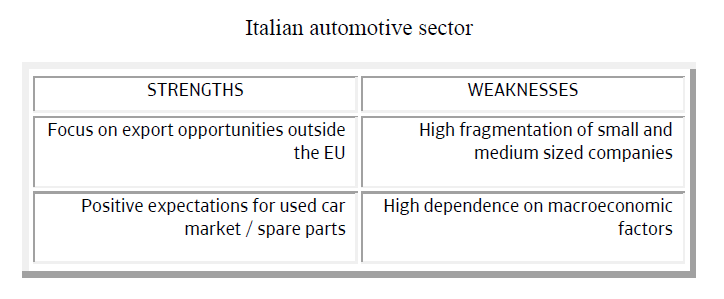

With the steep decline in car sales and production in recent years, many of Italy’s car suppliers still face lower profit margins. Smaller businesses have weak equity ratios, and solvency and liquidity depend largely on the customer portfolio. As a result, while companies focused on the domestic market face real challenges with both orders and payments, export-oriented businesses - especially those delivering to markets outside the EU - are faring better and we do not expect the financial situation of car suppliers to deteriorate further this year. Car dealers are still the weakest subsector: with little in the way of assets and equity, and exposed to pressure from both suppliers andcustomers, they have been challenged by lower sales in recent years and by the need to carefully manage their working capital.

On average, payments in the Italian automotive industry range between 60/90 to 120/150 days, depending on the end-buyer and whether working capital requirements can be obtained from banks or suppliers. Generally, payments are quicker when the end-buyer is a foreign company. Over the past few years domestic payment trends have been poor, although over the last six months we have seen fewer notifications and stable average amounts, and we expect this to continue for the rest of the year.

Insolvencies in the sector are high and have increased sharply over the past couple of years. We expect another slight increase (of about 5% year-on-year) or a levelling off this year.

We remain cautious when assessing risks in this industry. We collect as much information as possible to assess buyers’ creditworthiness, including their years in business, their management, and associated companies. To give our clients an accurate assessment of their buyers we seek the most recent financial information, including interim results, either directly from the buyer or from our client. In complex and sensitive cases we will visit the buyer to investigate their reference market, clients, bank dependence, and business strategies.

Related documents

1.3MB PDF